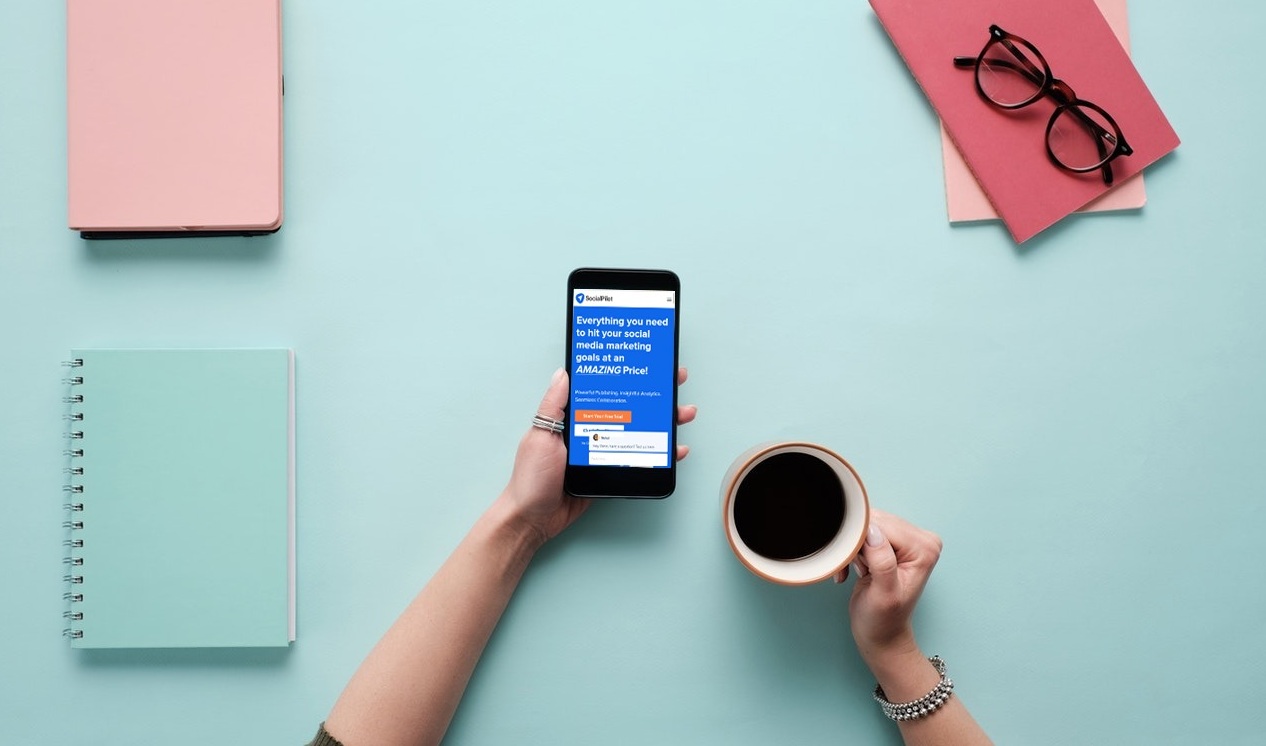

You’ve built your online store, and designed your website in an engaging, compelling way that reflects your brand’s unique flavor. Nice!

You’re setting up an ecommerce business, and it’s going well so far.

You’ve built your online store, and designed your website in an engaging, compelling way that reflects your brand’s unique flavor. Nice!

But you’re not done just yet. Because, before you can start selling, you’re going to need a way of actually accepting those payments. You need to be able to take credit and debit cards online – which, in turn, means you need a payment processing tool.

So what is a payment processing tool, exactly? And, more importantly, how do you choose the right one for your new ecommerce business?

For that, let us help. We’ve rounded up our top 5 payment processing tools – Stripe, Square, Amazon Pay, PayPal, and Adyen – below. Between pricing, extra features, payment security, and customer support, we’ll help you decide which payment processing tool is the best fit for you.

A payment processing tool is software that integrates with your ecommerce website, enabling you to accept credit and debit card payments online.

What are the best payment processing tools, though? Read on to find out.

One of the best-known names in payment processing, Stripe offers plenty to love for ecommerce store owners seeking a simple, effective way to sell online.

You’ll pay a fee of just 2.9% + 30 cents per payment – and there’s nothing in the way of set up, monthly, or hidden fees. You can create an account in moments, and start benefiting from Stripe’s full stack of payment solutions in days.

What’s more, Stripe offers a number of tools to help you optimize your checkout flow – and minimize friction at the point of sale.

You can offer your customers several ways to pay: be that online, with a payment link, via regular billing, or even in-person using the Stripe Terminal. Stripe also supports over 135 currencies – so it’s ideal for ecommerce store owners looking to expand internationally, and sell across borders.

With Stripe, you can rest easy knowing you’re protected by the best in payment security. Your data – and that of your cardholder – is all encrypted to the highest PCI DSS (Payment Card Industry Data Security Standard) compliance requirements. And you’ll get access to a secure online dashboard to monitor your takings.

On top of all that, Stripe offers 24/7 support via phone, live chat and email – plus a comprehensive knowledge base full of superb self-service resources.

Where Stripe offers simplicity, Square offers flexibility – especially when it comes to its array of pricing plans.

Square’s online payment processing plans come in three tiers:

And the processing fees? For card-not-present transactions (ones where your customer isn’t present, such as purchasing through your online store rather than a physical one), it’s 2.9% + 30 cents per sale. For accepting keyed-in sales – or payments you take using a card on file – Square will charge you 3.5% + 15 cents per transaction.

Sure – Square’s pricing plans give you a little more to think about than Stripe’s ‘one size fits all’ rates. But they also mean you can choose a plan that suits your online business’s unique payment processing needs to a tee. (To figure out exactly how much you’ll pay, Square’s fee calculator is an excellent place to start!)

Square’s flexibility isn’t limited solely to its payment plans, though – but it’s entire, impressive suite of tools for running your business and engaging your customers.

On top of payment processing, Square provides:

With Afterpay, Square even lets you offer your customers the chance to pay in installments, a la the ‘Buy Now, Pay Later’ model popularized by Klarna. Meaning it’s ideal for appealing to a new generation (Z) of consumers – one that demands increasing versatility and variety at the checkout.

With one of the most recognizable brand names in the world, Amazon Pay doesn’t just offer a slick, seamless payment processing service.

It offers trust.

After all, when your customers see an Amazon Pay-branded payment gateway sitting on your site, they’ll instantly feel more comfortable – even if that recent Lord of the Rings adaptation was anything but! And will feel far safer when it comes to entering their card details, and proceeding with a purchase on your online store.

Plus, the benefits of the Amazon association don’t stop there. When you take payments through Amazon Pay, you’re tapping into its network of over 200 million Prime customers across the world, through Amazon Pay’s co-marketing program.

You can even harness Alexa, Amazon’s virtual assistant, to provide your customers with real-time delivery notifications. And, if you’re looking to double down and rely on Amazon for your web hosting requirements too, you can – Amazon Web Services (AWS) is an affordable, straightforward place to start.

While some popular website builders, such as Wix and Squarespace, don’t currently support Amazon Pay, the payment processing tool does integrate with the likes of BigCommerce and WooCommerce – and its largely pretty ecommerce platform-friendly!

Another heavyweight of the payment processing world (and, founded in 1998, the most established tool on this list) is PayPal. Like Amazon Pay, PayPal benefits from both its brand name and its ubiquity – it has 426 million verified users and merchants across the globe.

So what does PayPal offer for ecommerce store owners looking to accept credit and debit card payments? The answer is plenty. Between invoices and estimates, recurring payments and subscriptions, and an attractive online checkout tool, PayPal offers variety in spades.

Despite being a relatively older payment processing tool, PayPal is well-equipped for the payment requirements of a modern audience. You can create – and track – shareable listings across multiple social media platforms, then sell through them via a payment link.

PayPal also supports a number of flexible installment-based payment solutions – enabling you to build customer loyalty, and endear your brand to your audience, by offering them more malleable ways to pay.

Head to Adyen’s website, and you’re greeted with the words “engineered for ambition”. Which is fitting, considering the extent to which this payment processing tool is built for scalability.

Adding more payment methods is easy – as is branching out into new local and international markets. Similarly, Adyen makes it simple to prevent and combat fraud, while its secure online dashboards allow you to keep tabs on sales, and harness data to optimize your payment flow.

Better still, there are no setup or monthly fees, while flexible payouts let you choose which currency you want to settle in – at a time most convenient for you.

No matter what your ecommerce site’s size, shape, scope or ambition, a good payment processing tool is a must.

Not only will they allow you to take payments (which, after all, is kind of the aim of the game!). They’re also a vital factor for building and maintaining trust with your customer at the point of sale.

After all, when you sell to someone online, you create a kind of social contract: agreeing to help keep their sensitive card and personal information safe while you transact.

If a customer doesn’t feel safe when making a purchase on your site – because you don’t have a reputable payment processing tool installed, for instance – they’re sure to abandon it. (And bounce straight into the waiting arms of one of your competitors!)

Fortunately, the five payment processing tools we’ve listed here – Stripe, Square, Amazon Pay, PayPal, and Adyen – are all among the finest money can buy. And will ensure your customers don’t only proceed with the purchase, but return to do so – again, again, and again!

He is a writer, editor, and content strategist based in Melbourne, Australia. He’s driven a wide range of content across industries and sectors: with deep cybersecurity and VPN expertise, plus specialisms in the digital payments, business software, and ecommerce spaces.